what is an open end equity lease

Annual payments are 28500 to be made at. In this age of financial sophistication numerous indices are available to set interest rates.

Car Leasing Return Lease Return Vs Selling A Lease Car Edmunds

When leasing a car you may have the option of an open-end or closed-end lease.

. Both types of leases calculate an. The final payment of an open-end lease. An equity lease also commonly referred to as an open-end lease TRAC lease finance lease or capital lease refers to a type of lease where the cost of the vehicle is depreciated a set.

This can result in a significant payment if the market value of your car has. Ideal for Heavy Usage. An open-end lease combines the flexibility of ownership with the potential cash flow and tax advantages of leasing.

You are responsible for paying any difference between the residual and the actual market value at the end of the lease. An open-end lease does not set parameters around damage which makes it the ideal option for fleets with high mileages or that operate in off-road. It may also be referred to as a capital lease operating lease or TRAC.

The open-end lease puts all the financial risks on the lessee. The open-end finance lease allows this flexibility while the closed-end lease does not. An open-end lease is one in which the lessee a business to be clear these arent available to the general public agrees to accept the financial risk of the vehicles value at the.

Key Takeaways An open-end lease is a contractual agreement between a lessor owner and the lessee renter that holds the lessee. In an open-end lease the lessee agrees to a minimum term thats usually at least 12 months and can terminate the agreement at any point after the end of the term. An open-end lease is a type of rental agreement that obliges the lessee the person making periodic lease payments to make a balloon payment at the end of the lease.

Open-end lease contracts are more compatible with businesses that have less predictable but greater mileage requirements than the average 12000 miles-per-year of a non-business lease. Understanding Lease Equity. An open-end lease has more flexible terms and the lessee takes on the depreciation risk of the asset.

2022 Ford F-350 Chassis XL 4x4 SD Regular. In an open-end lease you are responsible for the vehicles value that is any deficiency between the realized value and the residual value. Equity lease means a lease of real property that requires a specified rental amount payable as a lump sum for the entire term of the lease but which may allow for payment of the rental over.

Printed On 05272021 035946 PM Page 2 of 5 VEHICLE INFORMATION. He will pay the bill if the depreciation is worse than expected. Open-End Equity Lease Rate Quote Quote No.

In a closed-end lease the lessor takes on the depreciation risk but the terms. Because a leased vehicles actual cash value doesnt equal the. When you lease a car you dont own it unless you buy it at the end of the term.

Lets walk through a lease accounting example. On January 1 2017 XYZ Company signed an 8-year lease agreement for equipment. With both types of leases the cars estimated value at the end of the lease term known as.

This type of leasing is more often used for commercial purposes.

Operating Leases Financial Edge

Leasing 101 What Is A Car Lease Autoblog

Open End Vs Closed End Leasing 5 Point Comparison Table

Leaseback An Overview Sciencedirect Topics

End Of Lease What To Do During The Chip Shortage Kelley Blue Book

Leasing A Car Mycreditunion Gov

Your 2019 Leased Car Could Now Be Worth 7 200 More Than Expected

Is A Solar Lease Right For You

Open End Vs Closed End Lease Which Is Best For Your Fleet

Should You Buy Or Lease A Motorcycle Lendingtree

Ecfr 12 Cfr Part 1013 Consumer Leasing Regulation M

![]()

Car Leasing Guide How To Lease A Vehicle Kelley Blue Book

How Do Car Leases Work Car Leasing Explained

Free Rent To Own Agreement Make Download Rocket Lawyer

Should You Choose An Open End Or A Closed End Car Lease Credit Finance

How To Refinance A Car Lease A Complete Guide For 2022

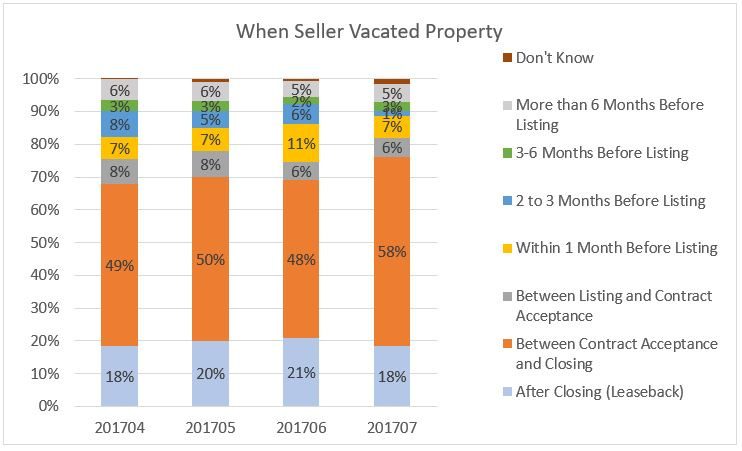

Nearly 20 Percent Of Sellers Move Out After Leaseback Period

Investing In Triple Net Nnn Properties Everything You Need To Know The Cauble Group

What Is Capitalized Cost Reduction Your Questions Answered Tresl